What is an employee cashback card? how to save more with your bYond card

In today’s economy, every penny counts. Whether you're buying groceries, grabbing lunch, or shopping for your kids, finding smart ways to stretch your salary is more important than ever. That’s where the bYond Card comes in, a prepaid employee cashback card designed to help you save while you spend.

What is the bYond card?

The bYond Card is a Mastercard® prepaid card offered as a workplace benefit through your employer. It gives you access to up to 15% cashback at over 85 UK retailers, including big names like John Lewis, M&S, Sainsbury’s, B&Q, and Caffè Nero. You can explore the full list of participating retailers directly on the bYond Card website or through the app.

It’s not a credit card; there’s no risk of debt. You simply top it up with your own money (or via salary deduction if your employer offers it) and use it like any other debit card. The cashback you earn is automatically added to your account 30 days after each transaction.

How Does It Work?

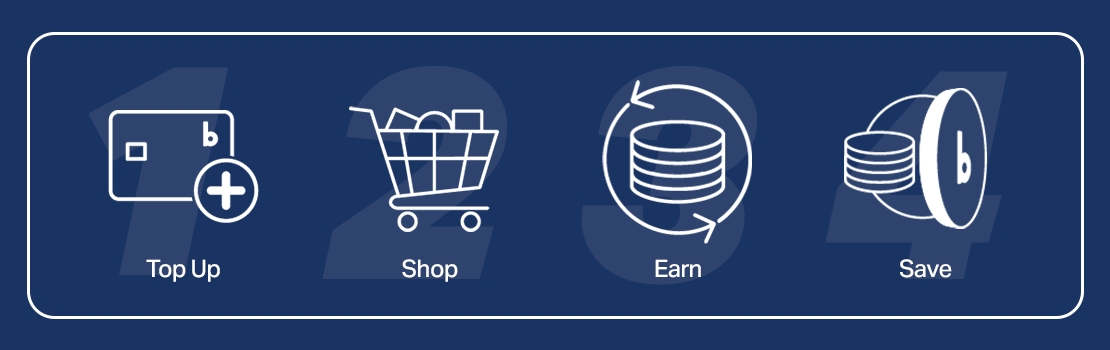

Using your bYond Card is simple:

- Top up your card via the app or online using your debit card.

- Shop at partner retailers in-store or online.

- Earn cashback (up to 15%) on every eligible purchase.

- Access your savings in your Vault and either save them or transfer them back to your card to spend again.

Where Can You Use It?

From weekly groceries to family meals, fashion, homeware, and even experiences, the bYond Card covers a wide range of everyday spending. But its benefits go far beyond the basics. Many users take advantage of the card to buy cinema tickets, shop for books at local and national bookstores, or even enjoy a coffee break at their favourite cafés.

Whether you're planning a weekend outing, picking up school supplies, or treating yourself to a new read, the bYond Card helps you save while doing the things you love. You can explore the full list of participating retailers, ranging from supermarkets and clothing stores to entertainment venues and lifestyle brands, directly through the bYond app or your online account.

Real Savings, Real Impact

On average, employees can earn £200–£500 per year in cashback just by switching to the bYond Card for their regular purchases. That’s money you can use for bills, treats, or even a rainy-day fund. As one NatWest employee put it:

“You can let the money build up and when it comes to Christmas, it doesn’t feel like you are spending money. Nice way to treat yourself.”

This kind of feedback reflects how the bYond Card isn’t just a financial tool, it’s a smart way to plan ahead and enjoy guilt-free spending during special moments.

Safe, Simple, and Smart

- No credit checks

- No hidden fees

- Regulated by the Financial Conduct Authority

- 24/7 access to your account and transaction history

- Works alongside retailer discounts and promotions

Tips to Maximise Your Cashback

- Plan your shopping around bYond partner retailers.

- Use the app to track cashback and find new offers.

- Combine with store promotions for double savings.

- Set monthly goals to turn spending into saving.

- Top up regularly to avoid missing out on cashback opportunities.

Ready to make your money go further?

If your employer offers bYond, sign up today and start saving. If not, talk to your HR team about bringing this benefit to your workplace.

?? Learn more at byondcard.co.uk